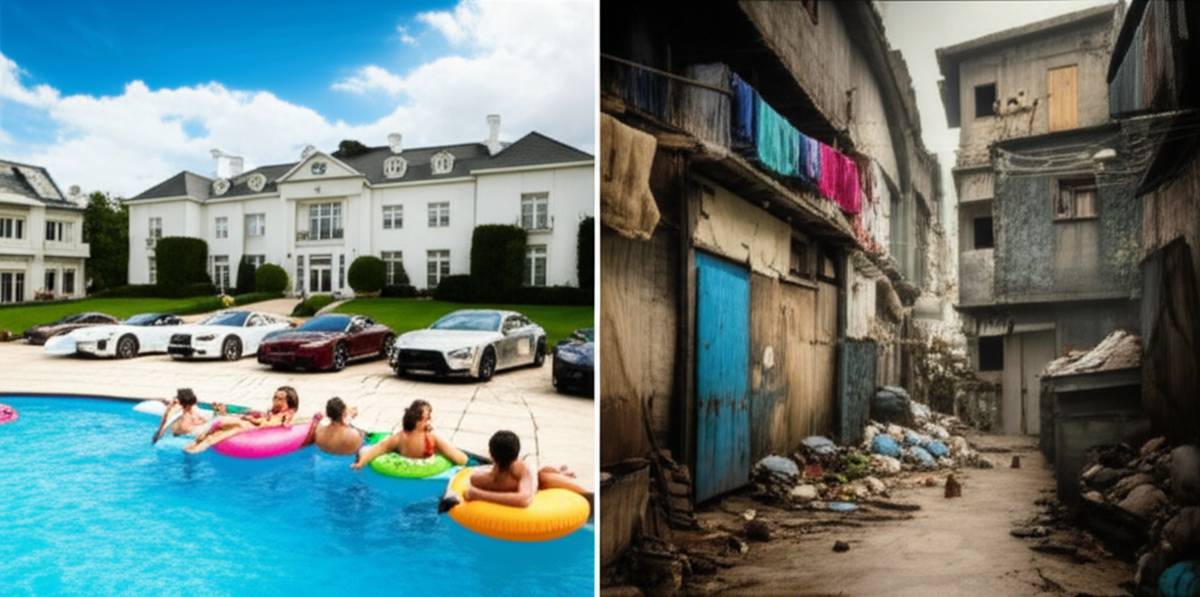

Rich vs. Poor: Understanding the Core Differences

When discussing financial success and wealth accumulation, the terms Rich vs. Poor often come up, highlighting more than just income disparities. These terms capture fundamental differences in mindset, habits, and life choices. In this article, we will explore these distinctions in depth, offering analytical insights to help you understand the factors shaping financial outcomes, and empowering you to create your own path to freedom and wealth.

The Psychological Divide: Mindsets That Separate Rich and Poor

The Rich vs. Poor comparison reveals that mindset plays a crucial role in financial success. While the wealthy often view money as a tool for opportunity, the poor may see it as a source of stress or scarcity. This difference in perspective influences behaviors significantly.

Rich individuals typically adopt a growth mindset, believing skills and financial conditions can improve with effort and learning. Poorer individuals may hold a fixed mindset, assuming their financial status is immutable. This distinction impacts motivation and willingness to take calculated risks.

Long-Term Vision vs. Short-Term Focus

Another key difference is in financial planning horizons:

- Rich: Prioritize long-term investments and wealth building strategies.

- Poor: Often focus on immediate needs or short-term gains.

Understanding and adopting a long-term wealth perspective can transform financial outcomes over time.

Financial Habits: How Rich and Poor Manage Money Differently

Financial habits strongly differentiate rich people from poor people. Analyzing these gives actionable insights for anyone looking to improve their personal finances.

Budgeting and Spending

- Rich: Practice disciplined budgeting, seek value, and invest surplus capital.

- Poor: Sometimes struggle with budgeting, leading to impulsive spending or living paycheck to paycheck.

Saving and Investing

The wealthy prioritize saving consistently and investing wisely. They understand the power of compound interest and the value of diversified portfolios. As Investopedia highlights, “Investing can help grow your money faster than a regular savings account.” (source)

Behavioral Patterns: Risk and Opportunity in Rich vs. Poor

Risk tolerance and the way opportunities are perceived mark another important contrast.

- Rich: Embrace calculated risks, often leveraging knowledge or technology to create digital income streams or automate growth, as explored on AI Automation.

- Poor: Tend to avoid risk due to fear of loss, limiting potential wealth gains.

Education and Continuous Learning

Continuous self-education is a hallmark of wealthy individuals. They read about money mindset, wealth-building strategies, and life design frequently, enabling them to adapt and innovate. Investing in knowledge pays dividends beyond direct financial gain.

Practical Steps to Transition from Poor to Rich Mindset

Embracing the traits that define the rich doesn’t require a magic formula but intentional effort. Here are steps you can take:

- Start Here: Clarify your financial goals with a structured plan (Start Here).

- Build Wealth: Learn and apply effective strategies to build wealth consistently (Wealth Building).

- Adopt a Rich Mindset: Challenge limiting beliefs and cultivate habits supportive of growth and abundance.

- Explore Digital Income: Discover scalable income avenues leveraging technology (Digital Income).

- Design Your Life: Align your financial and personal goals for meaningful success (Life Design).

Call to Action: Join the Billionmode Community

Ready to transform your financial story? Subscribe to our newsletter for weekly insights and practical advice to build wealth and live a meaningful life. Join thousands who are taking control of their future with Billionmode’s blog and resources.

FAQ About Rich vs. Poor

What is the main difference between rich and poor mindsets?

The rich mindset focuses on growth, opportunity, and long-term planning, while the poor mindset often centers on scarcity and short-term survival.

Can poor financial habits be changed to build wealth?

Yes, by developing disciplined budgeting, saving, investing, and adopting a positive money mindset, financial habits can improve dramatically.

How does risk-taking differ between the rich and poor?

Rich individuals tend to take well-calculated risks that can lead to growth, while poorer individuals often avoid risk due to fear of failure or loss.