Unlocking the Secrets: A Journey Through the History and Function of Money

Money, that ubiquitous medium of exchange, is so ingrained in our daily lives that we rarely stop to consider its origins or the vital roles it plays in shaping our world. This post will serve as your friendly guide, unraveling the fascinating history and diverse functions of money. Understanding the history and function of money isn’t just for economists; it’s crucial for anyone seeking to build wealth and achieve financial freedom, principles that are at the core of Billionmode’s mission. So, let’s embark on this enlightening journey!

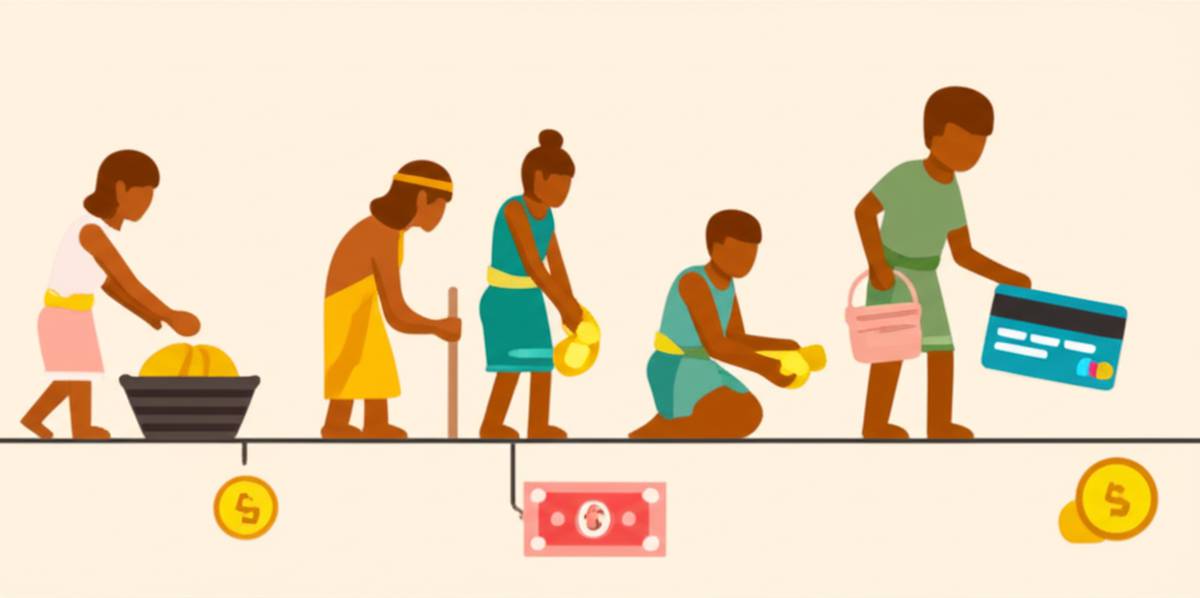

A Glimpse into the Past: The Evolution of Money

The story of money is as old as civilization itself. Before the shiny coins and digital transactions we know today, societies relied on a variety of systems to facilitate trade.

Barter: The Ancient Foundation

The earliest form of exchange was barter, a direct trade of goods or services. Imagine trading a chicken for a bushel of apples. While simple in theory, barter systems were often inefficient. Finding someone who had what you needed and wanted what you had was a challenge. This double coincidence of wants problem limited trade and economic growth.

Commodity Money: Tangible Value

To overcome the limitations of barter, societies began using certain commodities as a medium of exchange. These commodities had intrinsic value – meaning they were valuable in themselves, beyond their use as money. Examples include:

- Salt: Historically used in many cultures, including ancient Rome, as a form of payment.

- Livestock: Cattle and other livestock were common forms of currency.

- Grains: Essential for survival, grains served as a reliable medium of exchange.

- Shells: Cowrie shells, in particular, were widely used in Africa, Asia, and the Pacific islands.

- Precious Metals: Gold and silver, due to their durability, portability, and scarcity, became increasingly popular.

Metallic Money: Standardized Value

The development of coins marked a significant step forward. Coins, typically made of precious metals, were standardized in weight and purity, making them easier to use and more reliable than commodity money. Ancient civilizations like the Lydians (around 7th century BC) are credited with creating the first true coins. The standardization made transactions far more efficient and spurred economic development. Over time, governments took control of minting coins, further ensuring their quality and authenticity. This is important to consider when looking at aspects of wealth.

Paper Money: A Leap of Faith

Paper money emerged as a convenient alternative to bulky coins. Initially, paper money represented receipts for gold or silver held by banks or goldsmiths. These receipts were redeemable for the underlying precious metal. This system was known as representative money. Eventually, governments began issuing fiat money – money that is not backed by a physical commodity but derives its value from government decree. The value of fiat money depends on the public’s trust in the issuing government and its ability to manage the economy. For more helpful resources, check out the blog.

Digital Money: The Modern Frontier

In the 21st century, we’ve witnessed the rise of digital money, including electronic funds transfers, credit cards, and cryptocurrencies. These forms of money exist primarily as electronic data. Cryptocurrencies, like Bitcoin, represent a decentralized form of digital money that operates independently of central banks. The ongoing evolution of digital money continues to reshape the financial landscape. Understanding these changes is crucial in today’s economy. Investopedia offers a great overview of fiat money.

The Multifaceted Functions of Money

Beyond its historical evolution, understanding the functions of money is paramount to grasping its significance. Money serves several key purposes in an economy:

1. Medium of Exchange

This is arguably the most fundamental function. Money facilitates transactions by eliminating the need for barter. Instead of directly exchanging goods or services, people can sell their goods or services for money and then use that money to purchase other goods or services they need. This significantly simplifies trade and economic activity.

2. Unit of Account

Money provides a common measure of value. It allows us to compare the relative worth of different goods and services. For example, we can easily compare the price of a car to the price of a house because both are expressed in the same unit – money. This common unit of account simplifies accounting and financial planning.

3. Store of Value

Money allows us to transfer purchasing power from the present to the future. We can save money today and use it to buy goods or services later. However, it’s important to note that money’s ability to store value is affected by inflation. Inflation erodes the purchasing power of money over time. Therefore, people often invest their money in assets that are expected to maintain or increase their value, in line with Billionmode’s principles on how to start here.

4. Standard of Deferred Payment

Money allows us to make purchases on credit and pay for them later. Loans, mortgages, and other forms of credit are based on the ability to repay in money. This function is crucial for economic growth, as it allows businesses and individuals to make investments and purchases that they might not be able to afford otherwise.

Conclusion: Mastering Money for a Better Future

The history and function of money are intertwined, shaping our economic systems and influencing our individual financial well-being. By understanding how money evolved and the roles it plays, you can make more informed financial decisions, build wealth, and create a more secure future. Whether you’re saving, investing, or simply managing your day-to-day finances, a solid understanding of money is essential. Remember that building wealth is a journey, and every step you take towards financial literacy brings you closer to your goals.

FAQs: Demystifying Money Matters

What is the difference between money and currency?

Currency is the physical form of money, such as coins and banknotes. Money is a broader concept that encompasses anything accepted as a medium of exchange, unit of account, store of value, and standard of deferred payment. Therefore, all currency is money, but not all money is currency (e.g., digital money).

How does inflation affect the function of money as a store of value?

Inflation reduces the purchasing power of money over time. This means that the same amount of money will buy fewer goods and services in the future than it does today. High inflation can significantly erode the value of savings and investments, making it harder to preserve wealth. Therefore, it’s important to invest money in assets that are expected to outpace inflation.

Why is trust important for fiat money?

Fiat money is not backed by a physical commodity, so its value depends entirely on the public’s trust in the issuing government and its ability to manage the economy. If people lose confidence in the government or its monetary policy, they may stop accepting fiat money, leading to its collapse. Therefore, maintaining trust is crucial for the stability and value of fiat money.